•Oil rallies after OPEC does nothing, intensifying energy crisis

•Stock markets take another hit, tech leading the way lower

•Dollar awaits ISM services survey, kiwi looks to RBNZ rate hike

OPEC adds fuel to energy crisis

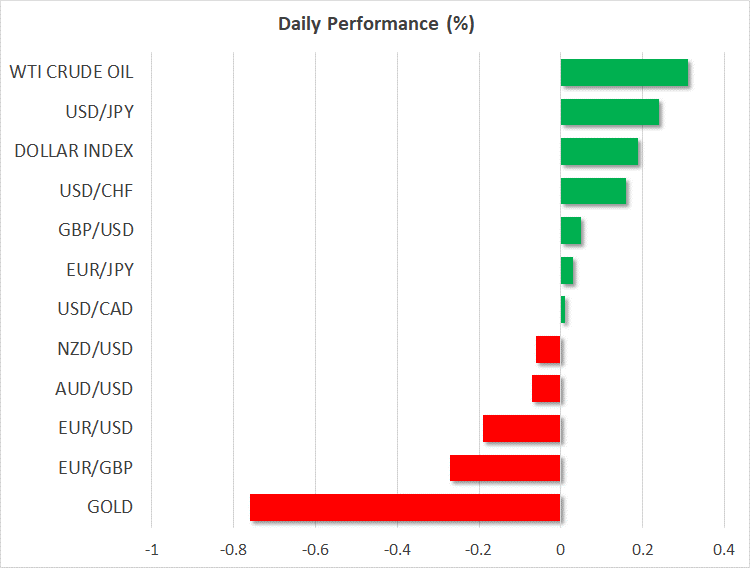

The world’s dominant oil cartel did not accelerate its production increases yesterday, propelling oil prices to new multi-year highs and fanning the flames of the raging energy crisis. With natural gas and coal prices going through the roof lately, crude oil has joined the party in sympathy as power producers look for any alternatives.

The risk is that this energy shortage will kneecap economic growth by squeezing real incomes for consumers faced with higher bills, and simultaneously keep inflation hot by inflicting more damage on struggling supply chains. Central banks cannot fix supply shocks – only governments have the tools to intervene.

Subsidies may be the weapon of choice as they would cushion the blow to consumers immediately and negate political turmoil, but that’s not a bulletproof strategy either as it would likely prolong and even exacerbate the pressure on energy markets. There aren’t any easy solutions, hence why investors have one finger on the panic button.

Tech stocks feel the heat

The unfolding crisis has left its marks on equity markets, with Wall Street closing sharply lower on Monday. What’s striking is that tech and growth names got hit the hardest whereas value plays held up relatively well, almost resembling a reopening rotation.

This aversion to tech and growth stocks likely comes down to Treasury yields, which refused to play along with the defensive mood and instead ticked higher as inflation worries remained on the radar. Higher yields decrease the present value of future cash flows in a typical valuation model.

Admittedly though, equity markets have been remarkably resilient. The S&P 500 is only 5% away from its record highs, which suggests that dip buyers haven’t thrown in the towel yet despite the escalating risks. Still, without any positive catalysts on the horizon, this sense of nervousness is unlikely to fade until the earnings season kicks off in two weeks, at which point corporate executives will shed some light on the magnitude of the fallout.

Dollar and kiwi in the spotlight

In the FX sphere, it was a relatively quiet session. The US dollar was relatively stable, unable to capitalize on the uptick in yields or the general risk-off tone. As for today, all eyes will be on the ISM services survey for September. It will provide crucial information on the growth outlook, supply chains and inflation, as well as how the labor market fared ahead of Friday’s employment report.

Meanwhile in Australia, the Reserve Bank adopted a slightly more cautious tone today, acknowledging the impact that the latest lockdowns will have on the economy. The reaction in the aussie was muted.

The real fireworks might be in the New Zealand dollar early on Wednesday, when the central bank is widely expected to raise interest rates. However, the risks surrounding the kiwi seem tilted to the downside as markets have almost fully priced in three rate hikes over the next three meetings, leaving lots of scope for disappointment if the RBNZ fails to execute perfectly.