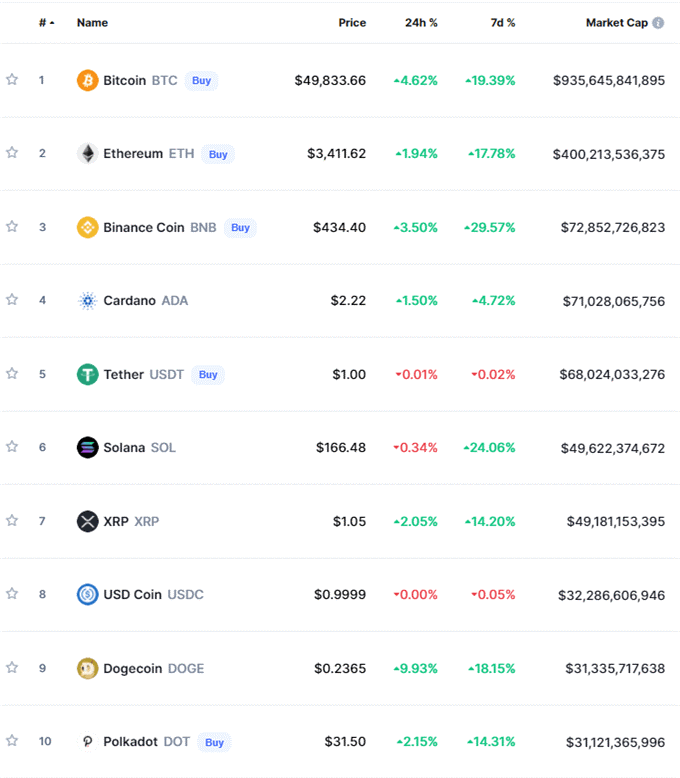

Bitcoin is leading the cryptocurrency higher with the market leader rallying over 20% from the lows seen last Thursday. The technical breakout above the short-term downtrend has allowed BTC to take out old levels of resistance, and all three simple moving averages, as positive sentiment continues to buoy the cryptocurrency space. Last week I looked at total market capitalization levels holding back the space and these are now beginning to fall as the Bitcoin rising tide is floating all the alt-coins boats. The next level of interest is at $2.244 trillion, a level already under pressure.

CRYPTOCURRENCY MARKET TOTAL CAPITALIZATION – OCTOBER 5, 2021

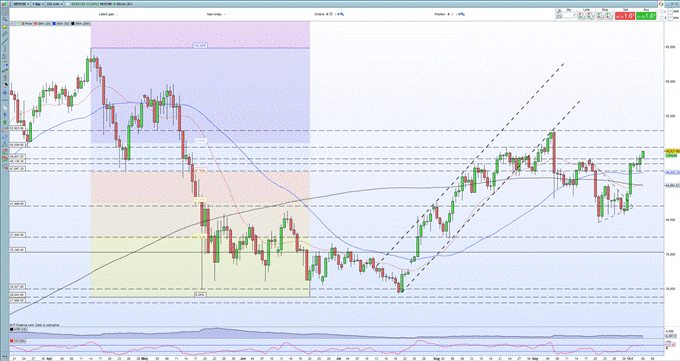

The renewed boost in positive sentiment is being driven by a number of factors. The SEC recently took a more constructive view of the market, especially futures-based Bitcoin ETFs, while Fed chair Jerome Powell stated that he was not looking to ban or limit the use of cryptocurrencies, instead suggesting regulation of stable coins. With a group of ETF applications sitting with SEC, any positive signal that these may be given approval will likely send prices even higher. Bitcoin is now pushing against a resistance zone between $50.5k off a prior swing high and the 61.8% Fibonacci level at $51.1k. If this zone is broken, the September 7 multi-month high at $52.9k will come under pressure. The CCI indicator is showing Bitcoin entering overbought territory highlighting the strength of the recent 20%+ rally

BITCOIN (BTC/USD) DAILY PRICE CHART OCTOBER 5, 2021

The alt-coin market is also showing low single-digit gains across the board today and low double-digit gains on a 7-day basis. If Bitcoin can continue its march higher, the alt-coin may start to deliver even greater percentage gains.